Bitcoin Finance without Intermediaries

A very easy intro allowing you to maintain your financial sovereignty with Bitcoin (which is the entire point of the stuff).

Note that this is not an attempt to show how the Bitcoin blockchain is useful for smart-contract defi apps. Instead, we show how Bitcoin may already be used in tandem with other chains and protocols, such that Bitcoin is made more useful to you as base money.

This is about satisfying certain financial desires with defi rather than custodians.

We’re going to talk about three specific desires that many Bitcoiners have:

1) We want to sell some BTC periodically (to avoid volatility/reduce risk, etc).

2) We want to borrow money using our BTC as collateral.

3) We want to stack more sats by earning yield on our BTC.

Critically thus far, Bitcoiners have had access to these financial services only though central intermediaries.

This is tragic and ironic.

Why? Because Bitcoin’s entire raison d’être is open, borderless, immutable money for sovereign individuals. The moment you utilize 3rd parties—specifically financial intermediaries like Coinbase, Blockfi, Kraken, FTX, Binance, etc.— you’ve lost your sovereignty. These are great companies, but your sovereignty ends at their signup screen.

Not your keys, not your coins.

Here’s the harsh reality all Bitcoiners must understand… all intermediaries or custodians of any scale are wards of the State. It is compelled on them.

Under duress, all custodians are legally required to spy on you, reporting your accounts and transactions to various governments. This violates your privacy and your human rights generally, as you are subject to this surveillance even without suspicion of wrongdoing. And it’s not just about surveillance; intermediaries can, and routinely do, freeze accounts and steal funds if requested by governments.

Apparently even donating to truck drivers in Canada is now cause for asset forfeiture.

Whenever you use intermediaries, you’re submitted to any arbitrary diktat of whatever politician is currently reigning. This is how banks work. It is not how Bitcoin should work.

Defi is the alternative; various financial protocols that extend the principles that make Bitcoin important. Defi expands the realm within which you are sovereign over your own money.

So how can Bitcoiners access the aforementioned financial services without intermediaries like Blockfi and Coinbase?

To Sell Bitcoin (without Intermediaries)

Get a multichain wallet such as XDefi or ShapeShift

Deposit some Bitcoin into the wallet

Use the trade function, to sell Bitcoin into a stablecoin, such as USDC.

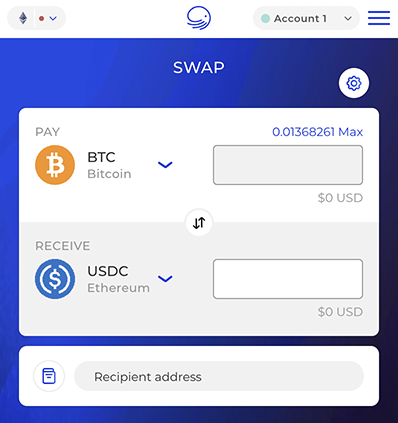

Screenshot of trading native Bitcoin into USDC via xdefi wallet.

With this method, you’ve reduced volatility risk by exiting part of your position into stables. How is this better than using an intermediary?

No KYC

No banks

No transaction limits

No permission needed

No territory restrictions

Faster and often more convenient

And obviously, if you wish to re-buy BTC when you’re again comfortable with the volatility risk, you can do the process in reverse just as easily.

This method did not exist a year ago; there was no way at scale for people to sell native Bitcoin into something stable without an intermediary. It works now because these wallets use a decentralized exchange called Thorchain in the background. Thorchain is the world’s only decentralized multi-chain liquidity pool (I wrote about it at length here).

Note: The above method doesn’t really help you spend your Bitcoin in the “real world.” But that is not the purpose of this post. This post is about the specific financial service of exiting or entering the volatility of Bitcoin given your risk preferences at any given time. Hundreds of millions of dollars of Bitcoin are bought/sold every day for this reason specifically, and until now 100% of that has been through intermediaries. It no longer has to be.

To Borrow Money using Bitcoin as Collateral (without Intermediaries)

Convert some native Bitcoin (BTC) into wrapped Bitcoin (wBTC) using one of the multichain wallets listed above (utilizing Thorchain in the background).

Deposit your wBTC into Aave, Rari, or Compound as collateral.

Then borrow stablecoins such as USDC from that service.

Modal for depositing wBTC on Rari (here, 10 BTC enables borrowing up to $361k of USDC or other stables)

With this method, you’ve used your Bitcoin as collateral to obtain a loan of fiat stablecoins. Normally this would be done with a company like Blockfi or Celsius.

So how is this better than using those intermediary companies?

No KYC

No banks

No permission needed

No territory restrictions

No paperwork or legal contracts

Faster and often more convenient

And how do the rates compare?

At the time of writing (4/7/22), for a $100,000 USDC loan, Blockfi is charging 9.75% + $2000 origination fee, and requires a 50% Loan-to-Value ratio (you must deposit at least $200k BTC to borrow $100k USDC).

On Aave, I can borrow the same $100,000 USDC for only 2.4% with zero origination fees. Loan-to-value is also more flexible (can be up to 82%). One caveat: the Aave rate is variable, so it could rise. Anecdotally, it’s generally in the 2-10% range.

So not only is this immutable, open, and private (like Bitcoin), it’s also more cost-effective. And time is money… if you want to withdraw some of your Blockfi-based BTC collateral, you will wait 2+ business days. Withdrawing collateral from Aave takes less 10 minutes and “business days” aren’t a thing.

A note on wBTC…

Critics will say that wBTC isn’t real Bitcoin, because it’s a wrapped token on Ethereum, only backed by BTC held at a custodian (Bitgo etc). That’s true, but we are here comparing this process to using an intermediary for a loan, in which the BTC you’ve deposited also isn’t real Bitcoin, it’s just a ledger entry on a centralized database. Irrefutably, wBTC is more open and more permissionless than custodial BTC. Don’t argue about it, just try it. Compare the user experience of BTC going into and then out of a custodian with the experience of BTC going into and then out of wBTC at Aave or Compound. It’s night and day.

In the near future (Q2/Q3 2022), Thorchain itself will enable borrowing against native Bitcoin within the protocol (as opposed to using wrapped BTC on Ethereum). This will be yet a further advancement for Bitcoin sovereign finance.

To Earn Yield on Bitcoin (without Intermediaries)

Convert some native Bitcoin (BTC) into wrapped Bitcoin (wBTC) using one of the multichain wallets listed above (utilizing Thorchain in the background).

Deposit your wBTC into Ribbon Finance.

Each week you’ll earn more wBTC, yielding 5-15%.

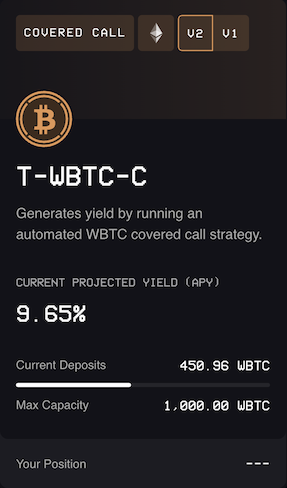

Ribbon Finance wBTC interface

Ribbon Finance is a clever defi app that utilizes other defi primitives to provide structured financial products. wBTC is one of several assets you can deposit.

Ribbon’s explanation, “The vault earns yield on its WBTC deposits by running a weekly automated covered call strategy. The vault reinvests the yield earned back into the strategy, effectively compounding the yields for depositors over time.”

Ribbon is just one app in which you can earn yield on the Bitcoin. Alternatively, the lending protocols mentioned above (Aave, Rari, and Compound) also enable you to earn low single-digits on your BTC.

In most cases, you can earn a higher yield on your BTC than if you used a traditional custodian like Blockfi. And, as this is all defi, the benefits again are…

No KYC

No banks

No permission needed

No territory restrictions

No paperwork or legal contracts

Faster and often more convenient

For those of you who want a little more frontier yield, you can deposit native (non-wrapped) BTC into the Thorchain liquidity pool and earn 15-20%. Note that this requires pairing it 50/50 with RUNE, and many Bitcoiners may not want that asset exposure. Consider however that by providing this liquidity, you are increasing the liquidity for the decentralized trading of Bitcoin, and helping others move away from custodians.

Sovereign Bitcoin Finance

This essay isn’t intended to convince anyone to take cold-storage BTC and put it into risky apps. The above apps all have risks (as do all custodians).

The intention is for those of you who are already using custodians for these services: realize that you can get better rates, and true financial sovereignty, by leaving those custodians and utilizing defi.

Just a year ago, none of this was possible with your Bitcoin. But this ecosystem is advancing rapidly (as free markets do), and all Bitcoiners should be familiar with the tools increasingly available to them.

When using intermediaries, you’re not a sovereign, but a serf.